ENERGY CRISIS COMMISSION

Protecting the UK from a future

energy crisis (73 pages, PDF)

It is essential we limit both the likelihood and severity of a future crisis using lessons from this one.

Executive summary

Given the scale of the shock that the energy crisis has delivered to households, businesses and the wider economy, as well as the impact on our national debt, the Commissioners felt strongly that there is a need to assess and learn from the crisis.

Much of Europe experienced an economy-wide and inflationary shock when gas prices rose in 2021 and 2022, largely as a result of Covid-19 lockdowns ending – causing demand to rebound – and Russia invading Ukraine. However, due to our high dependence on gas for power generation and home heating, the UK was highly exposed to supply disruptions and price spikes on international markets, and UK households and businesses felt the impacts of these price increases acutely; the International Monetary Fund has stated that the UK was the worst hit of any Western European country.

One overarching conclusion from the Commission is that it didn’t have to be this way. Years of underinvestment in demand reduction measures like insulating homes and clean energy technologies (including power generation, storage and modernising the grid) alongside a lack of crisis planning left the UK ‘critically vulnerable’: specifically, Great Britain was not prepared for a challenge to its energy security. But without decisive, urgent action, and investment the Commission finds that the UK remains ‘dangerously underprepared’ for a future crisis.

“The UK’s vulnerability to globally traded fossil fuel

prices is acute.”

Fuel poverty charity

What happened and why? Impacts and drivers of the crisis

A perfect storm of conditions caused gas prices to rocket in Europe. These included – gas demand rebounding post-Covid-19 and tensions between Russia and the West, which were tipped over the edge when Russia invaded Ukraine.

As the UK uses gas for around 40% of electricity generation and 85% of home heating, it was highly vulnerable to these price spikes. Other businesses rely on gas for heating, and industries – such as steelmaking – also use gas in industrial processes.

Slow progress on demand reduction measures, such as installing insulation in buildings, was highlighted as a significant exacerbating factor in evidence received by the Commission. This was particularly the case after the then government significantly scaled back energy efficiency schemes in 2012/13.

Despite very recent progress on low carbon energy, there was not as much deployed as there could have been over the last decade or so, for example because of the de facto onshore wind ban in England. This increased the UK’s exposure to high gas prices.

These were preventable factors that left the UK more exposed to international markets; the UK was the worst hit country in Western Europe according to the International Monetary Fund.

Insignificant or non-drivers of increased energy costs were green levies – which remained broadly stable – and declining indigenous gas production, as its price is largely set by international markets.

Household impacts

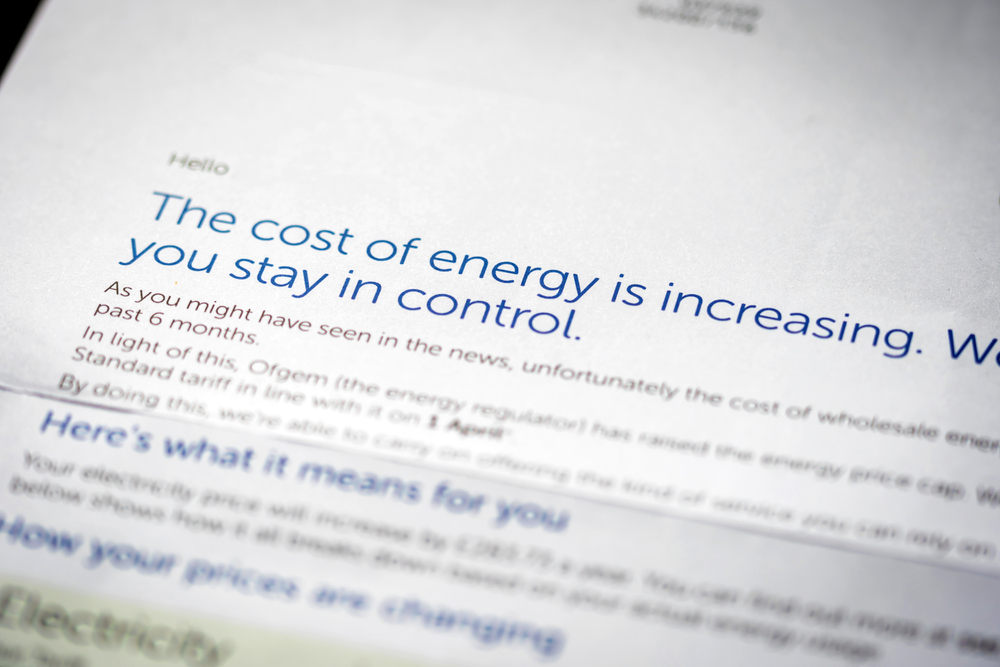

While prices soared across the board, not all households were impacted in the same way. Those on a low income, in inefficient and poorly insulated homes – including those living in privately rented homes which tend to be the least efficient – and with medical conditions struggled most. Consumers living in fuel poverty and with household debt were more likely to have a prepayment meter; for households with traditional prepayment meters, it was harder for these vulnerable groups to access support. At times industry estimates put the total number of households in fuel poverty at over 7.5 million and many are still struggling today as their financial resilience has been weakened over the course of the last few years. However, energy prices remain significantly higher than pre-crisis levels, with bills expected to remain high into 2025.

Business impacts

Businesses were also impacted differently depending on sector, size, and energy intensity. Some were able to bear cost increases, some passed costs down to consumers, and others simply could not stay open. Following on so quickly after Covid-19, the energy crisis chipped away at companies’ financial balances, with some organisations delaying or reducing investment as a result. This ultimately negatively influenced wider economic growth.

Cost of living impacts

The impacts of the energy crisis did not stop there. High gas prices affected the cost of producing fertiliser and therefore food. Higher food and energy prices added to inflation, causing it to reach the highest levels in 40 years. This filtered down into products and services across the whole economy. The wider cost-of-living crisis worsened as prices soared and the UK economy’s ability to grow was hampered by lower levels of spending and investment.

Impact of government inaction

Successive governments had the chance to lower the UK’s dependence on fossil fuels and avoid some of the worst of these impacts. Policies were delayed and investments cut that would have insulated homes and buildings and transitioned them away from boilers to reduce gas dependence. Significant progress has been made in building out offshore wind, but more renewables like onshore wind, which has seen an effective ban in England, would have further reduced the amount of gas needed for power generation. An accelerated switch from petrol and diesel cars towards electric vehicles would have likewise reduced oil dependence.

Households struggling over the course of the crisis have paid the price of inaction and underinvestment.

Lessons to be learnt

There is an opportunity for the UK to learn lessons from the causes of and response to the energy crisis. This will not only improve resilience to further shocks but support growth of the economy. It is clear that we must reduce our exposure to volatility in international oil and gas markets by transitioning to net zero. Prices are largely set by international markets so domestic supply, which will continue to decline, makes little difference to prices.

This means:

- reducing price volatility and improving security of supply of electricity through low carbon power, flexibility and storage back-up, with less reliance on unabated gas

- massively cutting energy demand through better insulated homes, switching to heat pumps and electric vehicles

- developing much better targeting of help to the most vulnerable households, in the event of another crisis

To lessen the impacts of a future crisis, which the UK is currently unprepared for, data sharing between the Government, industry and charities must be improved to allow those who need help most to be targeted. The UK’s households, businesses and public purse cannot afford to spend the same on support measures again. Effective crisis mitigation could unlock significant economic opportunities as the UK could become a more attractive place for investment, competing with the likes of the US. It is essential we limit both the likelihood and severity of a future crisis using lessons from this one.

Process and scope

The Commission held a call for evidence over the summer and received responses from 25 organisations or individuals, including: energy suppliers; consumer advocates and advice services; trade associations and business groups; and charities. Academics also submitted evidence. This evidence was analysed and used to inform the findings of the report, along with other information from the Commissioners themselves.

The Commission heard evidence from across the UK, including the devolved nations (mainly Scotland). This report makes high-level recommendations for the UK as a whole and central government. The UK Government pledged support for Northern Ireland during the crisis, but as the nation has different interactions with Great Britain and Ireland’s energy markets – being part of a single market across the island of Ireland – it is difficult to apply some of the report’s findings, particularly around power and regulation. Therefore, the report’s overall relevance to Northern Ireland may be more limited compared to its relevance for the other devolved nations.

Although there was some volatility in oil prices, the Commission – and this report – focus primarily on gas and electricity during the energy crisis. We consider this crisis to have started in August/September 2021, when gas prices started to rise, however the key tipping point for record prices was in February 2022 when Russia invaded Ukraine.